Calendar Year Vs Tax Year – Workers who haven’t hit that max limit — and who want to — may be able to boost contribution amounts in the last few weeks of the calendar year. 2. Consider tax-loss harvesting. One . You’ll also need the actual tax forms you plan to fill out, called the 1040 form. The form changes each calendar year, so make sure you’re using corresponding forms. For example, I would use the .

Calendar Year Vs Tax Year

Source : www.thebalancemoney.com

What Is the Tax Year? Definition, When It Ends, and Types

Source : www.investopedia.com

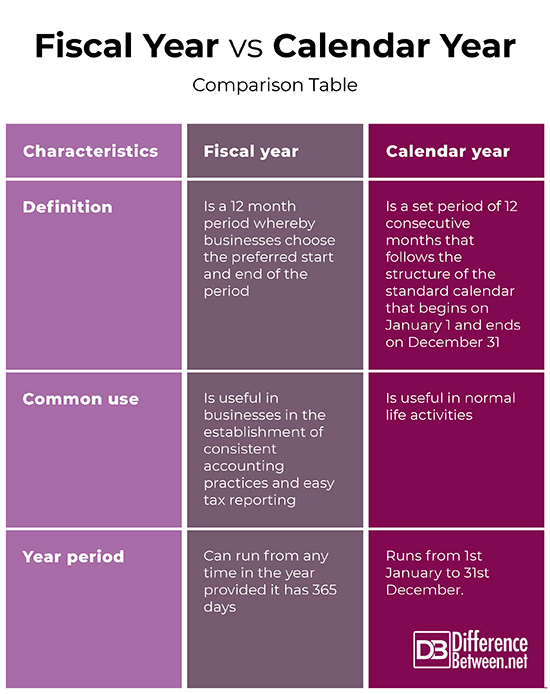

Calendar Year vs Fiscal Year | Top 6 Differences You Should Know

Source : www.educba.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

Difference Between Fiscal Year and Calendar Year | Difference Between

Source : www.differencebetween.net

Fiscal Year Definition for Business Bookkeeping

Source : www.beginner-bookkeeping.com

Fiscal Year vs. Calendar Year: Key Differences | by Blogwaly | Medium

Source : medium.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

Fiscal Year vs. Calendar Year. Helping You Undersand The Difference

Source : www.excelcapmanagement.com

What Is the Tax Year? Definition, When It Ends, and Types

Source : www.investopedia.com

Calendar Year Vs Tax Year What Is a Fiscal Year?: Despite the delay to Making Tax Digital for income tax self assessment, unincorporated businesses will have to report their results on the tax year basis from 2024/25 onwards, breaking the tenuous . This year tax filers are going to get a few extra days Tracy Byrnes: All right, so mark your calendars. These are important dates. Lisa, thank you so much for taking the time with us. .

:max_bytes(150000):strip_icc()/fiscal-year-definition-federal-budget-examples-3305794_final-c54e01b8314f424a8aefacb8c126d192.png)

:max_bytes(150000):strip_icc()/taxyear-c3f5618cd504499583b0543cb4d6b31e.jpg)

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)

:max_bytes(150000):strip_icc()/FiscalYear-End_v1-e3337960a07c4b9f9a9d394e934caca2.jpg)